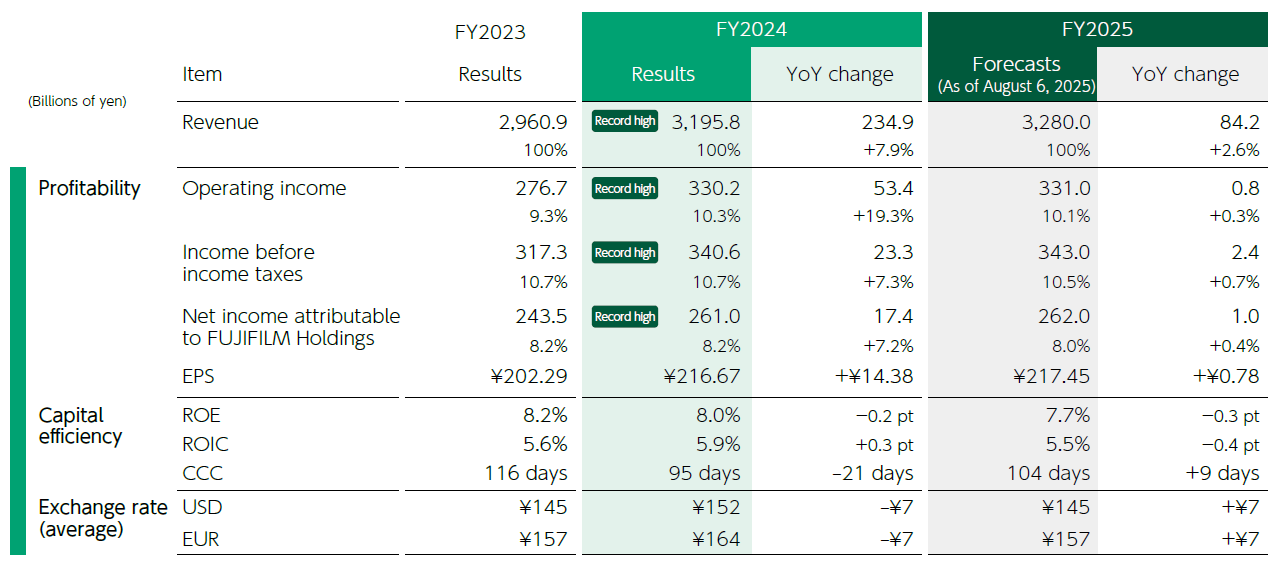

Record-high results

In fiscal 2024, revenue increased 7.9% year on year to ¥3,195.8 billion, surpassing ¥3 trillion for the first time. Operating income rose 19.3% to ¥330.2 billion, income before income taxes increased 7.3% to ¥340.6 billion and net income attributable to FUJIFILM Holdings grew 7.2% to ¥261.0 billion. Revenue marked a record high for the third consecutive year, operating income for the fourth consecutive year and net income attributable to FUJIFILM Holdings for the fifth consecutive year. In the Healthcare segment, revenue exceeded ¥1 trillion for the first time, driven by the strong performance of the Medical Systems business, which saw steady growth in endoscopes and medical IT, as well as the Bio CDMO business, which expanded contract manufacturing of antibody drugs at its large-scale production facility in Denmark. Other performance drivers were the Semiconductor Materials business, which benefited from growing demand for advanced semiconductors for generative AI and from a semiconductor process chemicals business acquired in fiscal 2023, as well as the Imaging segment, which saw strong sales of instax instant photo systems and digital cameras.

In fiscal 2025, we will work to further accelerate growth in the Healthcare and Electronics segments while strengthening profitability across all of our businesses. Externally, responding to U.S. tariff policy remains a key challenge. We will take timely and appropriate actions, such as reviewing our supply chain and implementing additional cost reductions, to minimize the impact on our operations. As a result, while accounting for the negative impact of tariffs, we forecast the following record-high figures for fiscal performance:

• Revenue: ¥3,280.0 billion (+2.6% YoY)

• Operating income: ¥331.0 billion (+0.3% YoY)

• Income before income taxes: ¥343.0 billion (+0.7% YoY)

• Net income attributable to FUJIFILM Holdings: ¥262.0 billion (+0.4% YoY)

Leveraging our core growth areas and a well-defined investment strategy, we will move into the next phase of enhancing corporate value.

One factor behind our outlook for continued solid earnings growth is the expansion of our Bio CDMO business. Since acquiring MSD Biologics and Diosynth in 2011, the business has expanded steadily through a series of strategic M&As and capital investments. In fiscal 2024, we made steady progress in contract discussions related to our Denmark site―equipped with large 20,000-liter production tanks―and our North Carolina site in the United States, supported by strong demand for biopharmaceutical manufacturing. During the year, our North Carolina site concluded a 10-year manufacturing agreement worth more than US$3 billion with Regeneron Pharmaceuticals. As a result, we have secured long-term agreements for the site’s first-phase investment facility, including the major contract announced in 2023 with Janssen Supply Group, part of the Johnson & Johnson Group. For the second-phase investment facility, we have made progress in negotiations with several major pharmaceutical companies and have already signed long-term contracts for four production tanks. At our Denmark site as well, the first-phase investment facility, which came online in 2024, has been ramping up smoothly with production now fully booked through fiscal 2028. For the second-phase investment facility, scheduled to begin operation in fiscal 2026, we have received multiple program orders and are making good progress in securing contracts as targeted in the medium-term management plan. We project that these large-scale manufacturing facilities will generate sales of ¥200 billion in fiscal 2026 and ¥500 billion in fiscal 2030.

In the Semiconductor Materials business, another growth driver, we are supporting Tata Electronics Private Limited, a major electronics manufacturer in India, to establish a semiconductor materials ecosystem in India. We will develop and supply semiconductor materials tailored to the needs of Tata Electronics, which is constructing India’s first front-end semiconductor manufacturing plant and a large scale back-end manufacturing facility. By capturing demand in India’s rapidly growing semiconductor market, we plan to further accelerate the growth of our Semiconductor Materials business.

Fiscal 2024 marked the peak of our capital investments for medium- to long-term growth, centered on the Bio CDMO business under VISION2030. Starting in fiscal 2026, we expect these investments to generate positive free cash flow across the Company. Given these developments, we believe we have entered a new stage, during which we will further accelerate efforts to enhance the Fujifilm Group’s corporate value through our continued focus on profitability and capital efficiency. By accelerating initiatives to reduce our cost of capital in tandem with the strategies outlined in VISION2030, we aim to further enhance our earnings power and evolve into a more profitable company.

Generating returns on growth investments

As part of our efforts to improve capital efficiency, we have set return on invested capital (ROIC) and cash conversion cycle (CCC) as KPIs and have been deepening initiatives in each business. We estimate our cost of capital to be around 8%‒9% and our weighted average cost of capital (WACC) to be in the 5%‒6% range, and in fiscal 2024 our ROIC increased 0.3 percentage point year on year to 5.9%. Due to active investments in the Bio CDMO business and Semiconductor Materials business, the current ROIC is at a level roughly equivalent to the WACC. The key challenge now is to generate solid returns from these investments to drive ROIC higher. To this end, we will continue advancing initiatives across all businesses. In Bio CDMO, for example, we will commission large-scale manufacturing facilities as planned and steadily translate contract discussions into confirmed orders. In the Semiconductor Materials business, we aim to further improve profitability by strengthening our global supply network and realizing synergies with the newly integrated semiconductor process chemicals business. For details on each business strategy under VISION2030.

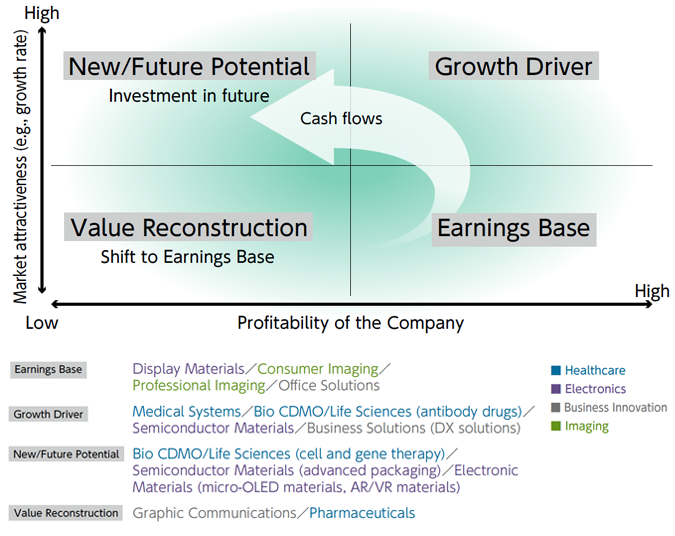

Continuous business portfolio transformation

At the core of these initiatives is our robust business portfolio. We have a unique portfolio that combines New/Future Potential and Growth Driver businesses―represented by our robust investments in segments with growing markets, such as Healthcare and Electronics―with strong Earnings Base businesses (cash cows), including the Business Innovation segment and Imaging segment, which support these growth investments. Under VISION2030, we will continue reviewing our business portfolio while assessing market attractiveness and profitability. To this end, we will focus on business renewal and transformation with the goal of achieving an operating margin of 10% or higher across all businesses.

In Graphic Communications, positioned as a Value Reconstruction business, we further advanced global structural reforms, including by streamlining our lineup of analog printing products and closing an overseas ink factory. In fiscal 2023, we integrated the former Business Innovation segment (now the Business Solutions business and Office Solutions business) and the Graphic Communications business under FUJIFILM Business Innovation. Since then, we have been steadily generating synergies, including by expanding sales in new markets through the shared use of sales channels and customer networks.

In Pharmaceuticals, also positioned as a Value Reconstruction business, we are shifting our focus from small-molecule drugs to biopharmaceuticals. At our Toyama site, we are preparing a new manufacturing facility for biopharmaceuticals, such as antibody drugs and antibody-drug conjugates (ADCs), which is scheduled to begin operation in 2027. To improve ROIC, we will transition these Value Reconstruction businesses into Earnings Base businesses and making them contributors to earnings, thereby increasing profitability.

Decisions on business divestment and withdrawal

To continuously optimize our business portfolio flexibly in line with changing conditions, we take a balanced, case-by-case approach to investment decisions on capital expenditures and M&As, and the Healthcare segment, positioned as a Growth Driver business, is no exception. If we determine that we are not the best owner of a business, we have made timely decisions to divest or withdraw from it. In the Healthcare segment, we withdrew from several businesses during the previous medium-term management plan period. These included the sale of Japan Tissue Engineering Co., Ltd., a provider of regenerative medicine products (2021), the sale of our radiopharmaceuticals business (2022) and the sale of a business related to electronic medical records and medical-receipt systems (2023). Under our current medium-term management plan as well, we will continue making timely decisions to optimize our business portfolio and improve capital efficiency. In June 2025, for example, we completed the sale of our medical media business within the LS Solutions business.

Enhancing asset efficiency

In fiscal 2024, we shortened our CCC by 21 days to 95 days than ks to improvements in accounts receivable turnover and inventory turnover through supply chain optimization. We also enhanced asset efficiency by further reducing cross-shareholdings and selling off underutilized real estate assets, which together generated cash inflow of ¥495.2 billion, up ¥24.6 billion year on year. Although capital expenditures centered on the Bio CDMO business increased, overall cash outflows declined ¥51.1 billion to ¥611.1 billion, due to reduced spending related to business acquisitions. Accordingly, adjusted free cash flow (excluding business acquisitions) resulted in cash outflows of ¥112.0 billion.

Going forward, we will continue enhancing asset efficiency by improving CCC and reducing cross-shareholdings while ensuring steady investment returns from the Bio CDMO and Semiconductor Materials businesses. We aim to achieve positive company-wide free cash flow in fiscal 2026 and raise ROIC to 9% or higher by fiscal 2030.

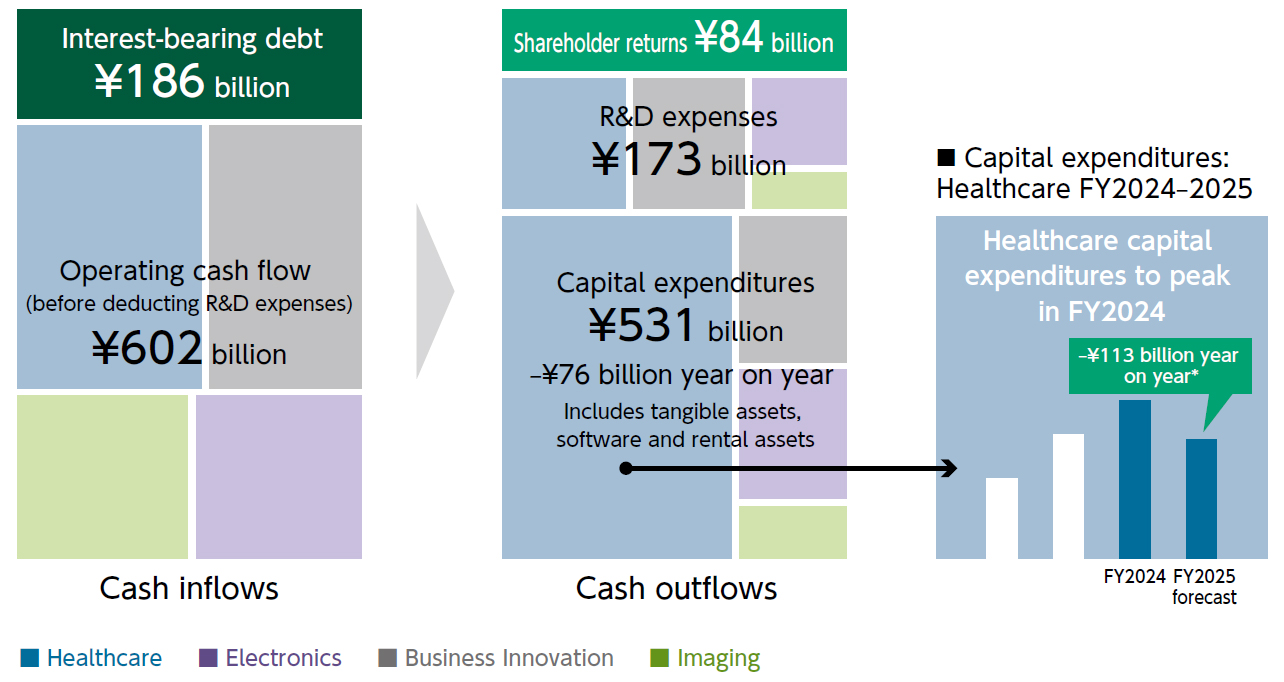

Cash allocations in fiscal 2025

Our plan under VISION2030 is to invest a total of ¥1.9 trillion in growth investments (combined R&D expenses and capital expenditures) from fiscal 2024 through fiscal 2026, exceeding the level under VISION2023. Of this total, ¥1.6 trillion is to be allocated to the New/Future Potential and Growth Driver businesses. In the first year, fiscal 2024, we made capital investments exceeding ¥600.0 billion, primarily in the Healthcare and Electronics segments. In fiscal 2025, we plan to allocate ¥531.0 billion in cash to capital expenditures and ¥84.0 billion to shareholder returns. Capital expenditures in the Healthcare segment, which peaked in fiscal 2024, are projected to decline ¥113.0 billion year on year in fiscal 2025.

Under our balance sheet management framework, we are committed to maintaining financial discipline and strengthening cash management, allocating internally generated funds to investments to minimize any increase in interest-bearing debt. To this end, we will keep the interest bearing debt/EBITDA ratio within 2x and strive to sustain an international credit rating of single-A or higher, thereby pursuing optimal financial leverage while ensuring capital structure stability. In fiscal 2026, we expect EBITDA to reach approximately ¥600.0 billion and interest-bearing debt to total around ¥850.0 billion, resulting in a debt/EBITDA ratio of about 1.4x.

* The chemical reagents business has been reclassified from the “Electronics (AF Materials)” segment to the “Healthcare (LS Solutions)” segment. Information for FY2024 has been restated in line with this change in classification.

Shareholder return policy

With respect to shareholder returns, we have implemented year-on year dividend increases for 15 consecutive years through fiscal 2024, targeting a payout ratio of 30%. For fiscal 2025, we plan to pay an annual dividend of ¥70 per share, marking 16 consecutive years of dividend increases. Going forward, we will continue paying stable and sustained dividends with a target payout ratio of 30%, while maintaining a balance between business growth and financial discipline. We will also consider and execute share buybacks in a flexible manner, taking into account comprehensive factors, such as cash flow and share price conditions. By optimizing financial leverage and adhering to our shareholder return policy, we will pursue the most appropriate capital structure.

Reorganizing business segments and enhancing disclosures to support investment decisions

In fiscal 2024, we integrated the Display Materials, Industrial Products and Fine Chemicals businesses―part of the Electronics segment―to launch unified operations under the Advanced Functional (AF) Materials Division. In the AF Materials business, we have centralized human resources and business assets to generate synergies across adjacent fields. By sharing expertise in new business development―grounded in our core technologies and deep understanding of the market―across both business and market axes, we are strengthening and enhancing our market development capabilities. In investor communications, we now disclose the performance of the Electronics segment as consisting of two sub-segments―the Semiconductor Materials business and the AF Materials business―thereby making our future growth scenarios easier to understand.

For the Bio CDMO business, fostering investor understanding of growth investments aimed at achieving positive cash flow remains an important challenge. Since announcing our growth strategy under VISION2030, we have worked to enhance communication with investors by holding business briefings and site tours. We have also improved disclosure by separately reporting the profitability of our large-scale facilities, which continue to perform well, and our small and medium-sized facilities, which have been affected by market weakness, as well as by providing updates on the progress of negotiations related to facilities under construction.

Governance and human resources to support the management plan

To achieve the goals set out in VISION2030 and meet the expectations of our investors over the long term, we must have an effective Group wide governance framework to ensure the plan’s successful implementation.

This framework is our Group-wide management system, which enables swift and appropriate decision-making and monitoring from both a business and company perspective. Its foundation is our unique financial data‒driven management approach, supported by “One-Data” (Fujifilm’s internal management data cockpit)*. Through past M&A activities, we have welcomed a diverse range of companies into the Group, resulting in the existence of multiple systems worldwide. By establishing a cloud-based platform that consolidates ERP data from each company, we can now visualize key KPIs, such as profit/loss, CCC and purchasing amounts, by business and company. We can also conduct drill-down analysis of the data at the product or supplier level. This enables everyone, from top management to frontline employees, to access and utilize the same information, facilitating swift and effective discussions among stakeholders across different businesses, companies, or combinations thereof, all based on a common set of metrics.

We have also digitalized our approval workflow to ensure the reliability and efficiency of the “Fujifilm Intercompany Approval Policy (FIA),” the delegation of authorization matrix that governs the approval process for important business executions across the Group. Under the previous manual process, applicants obtained approvals from final and prior approvers within the Group by e-mail, in accordance with individual company approval rules and the FIA. To improve this, we introduced the “Fujifilm Approval System (FAST)” platform. By operating individual company approval rules and the FIA in a unified manner within FAST, we established a seamless, one-stop application to-approval process that transcends company boundaries. By incorporating a function that automatically assigns final and prior approvers based on the approval category, we have built a system that enables complete and efficient submission of approval requests. In fiscal 2023, we fully implemented both FAST and the FIA across our domestic Group companies. For our overseas Group companies, we fully applied the FIA in February 2025 and are now working to introduce FAST as well. Through these initiatives, we will further enhance the speed of decision-making and strengthen Group-wide governance.

At the same time, our sustainable growth depends on the power of each individual employee, so it is essential to ensure a high level of employee engagement. Under VISION2030, we set “Sustainable engagement score of 80% or above” as a non-financial target. In fiscal 2024, we also incorporated the achievement level of the engagement score into the KPI for medium-term performance-linked share-based remuneration. We will continue working to enhance employee motivation and performance―through talent development, workplace environment improvements and wage increases―to further strengthen engagement on an ongoing basis. Through these initiatives, we will increase the likelihood of achieving our management plan and further enhance our corporate activities.

* The internal management data cockpit exclusively for Fujifilm’s in-house corporate purposes.

Targeting further increases in corporate value

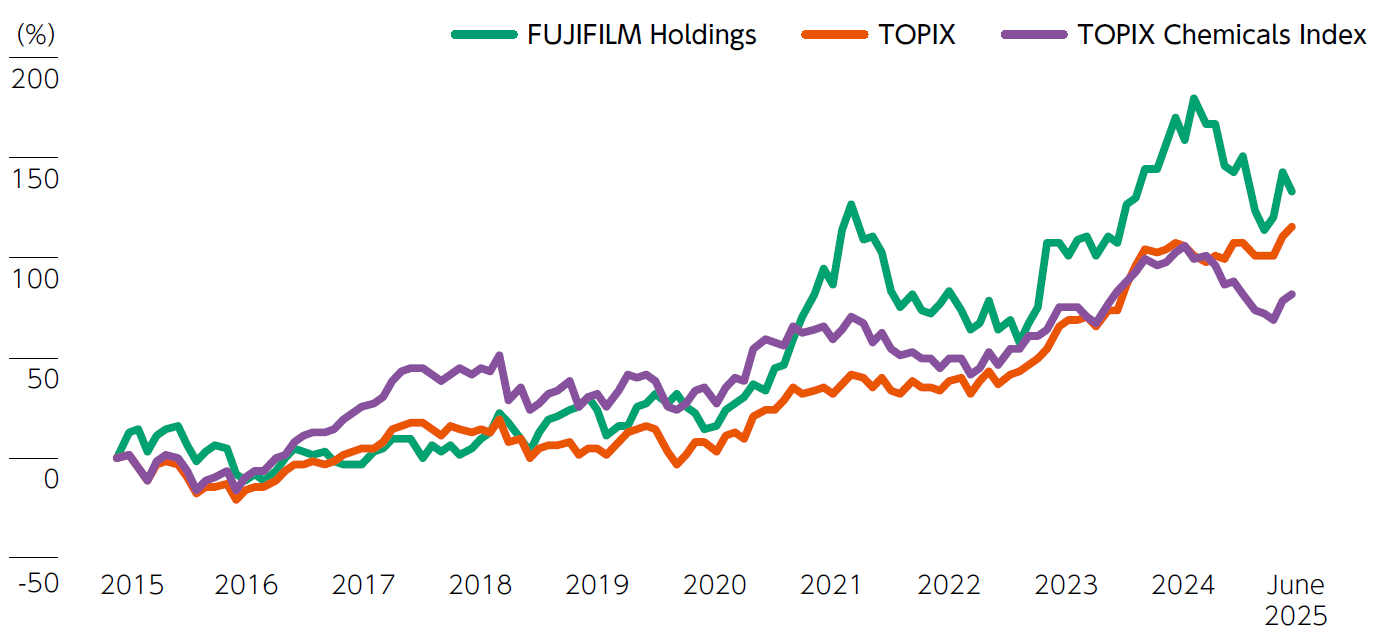

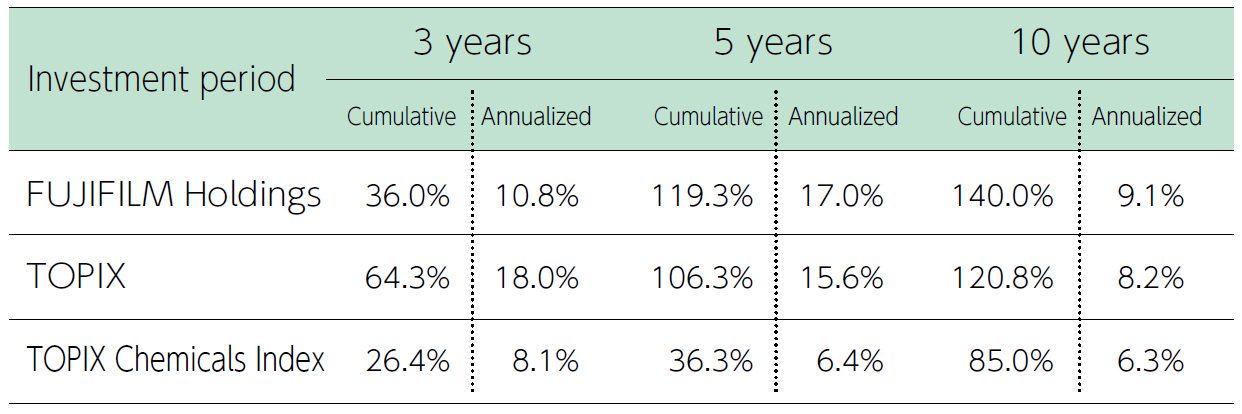

Our total shareholder return (TSR) has outperformed the TOPIX Index and the TOPIX Chemicals Index over the past five and 10 years. However, our price-to-book ratio (PBR) stood at just above 1x as of the end of June 2025, indicating that there is still ample room for improvement. To that end, it is essential that we advance the initiatives outlined above throughout the VISION2030 period. We will continue transforming our business portfolio to maintain an optimal balance while creating new growth areas from short-, medium- and long-term perspectives. At the same time, we will engage in thoughtful dialogue about these initiatives with stakeholders, including shareholders and other investors. Through these efforts, we aim to foster strong empathy and expectations for our future growth.

Notes:

1. TSR: Total return on investment, including capital gains and dividends

2. Both indexes include dividends

3. Annualized figures are geometric averages

4. Prepared by the Company based on data from QUICK